Gst hst new house rebate application owner built Pilot Mound

GST190 GST/HST New Housing Rebate Application for Houses GST/HST New Housing Rebate Application for Owner-Built Houses Use this form to calculate and claim your rebate if you are an individual who: † built a new house or substantially renovated your house; † added a major addition to your house as part of a renovation of your existing house; or

New Housing Rebate Canadian Underwriter

HST housing rebate Archives Rebate4U. GST/HST new housing rebate. Owners who build their own houses are eligible to claim the new housing rebate for part of the GST and/or the federal portion of the HST. In order to claim, however, these owners must satisfy all of the following: The home that you built or renovated is the primary place of residence for you or your relation., Rebate4U: Your New Home HST Rebate Experts. At Rebate4U Inc., our New Home HST Rebate Ontario experts help homeowners obtain the HST rebates they’re entitled to from government agencies. Whether the application is for your principal home or an investment property, our expertise, knowledge and experience in the rebate process will help you receive the maximum rebate amount you deserve..

GST/HST Housing Rebate In addition to a first-time homebuyer credit and land transfer tax exemption, you may be eligible to receive the GST/HST New Housing Rebate when considering your new home. An eligible new Homebuyer can claim a rebate for 36% of the federal portion (5%) of the HST … If you’re a property owner filling out a GST/HST new housing rebate application, it’s important to comply with all the guidelines, and provide all the requisite paperwork. You will be using the GST/HST new housing rebate application if you’ve built a brand new house, or if you’ve made a substantial renovation to your house. How […]

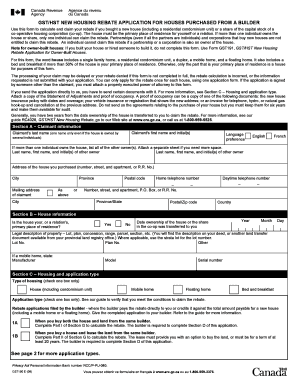

Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. Rebate4U: Canada’s Best Source to Help you Claim a Condo HST Rebate/ NRRP Rebate. Have you purchased a newly built house or condo in the past 2 years? You may be eligible for a GST/HST New Residential Rental Property Rebate (NRRP Rebate) also known as the Condo HST Rebate for up to $30,000. For people living in their new home, it is much

GST/HST new housing rebate. For an owner-built house, as described on page 7, you can claim the GST/HST new housing rebate for some of the GST and/or the federal part of the HST that you paid to build the house if you meet all of the following conditions: Rebate4U: Canada’s Best Source to Help you Claim a Condo HST Rebate/ NRRP Rebate. Have you purchased a newly built house or condo in the past 2 years? You may be eligible for a GST/HST New Residential Rental Property Rebate (NRRP Rebate) also known as the Condo HST Rebate for up to $30,000. For people living in their new home, it is much

GST/HST New Housing Rebate Application for Owner-Built Houses Use this form to calculate and claim your rebate if you are an individual who: † built a new house or substantially renovated your house; † added a major addition to your house as part of a renovation of your existing house; or Individuals can claim the GST/HST new housing rebate when they have paid for a new house or significantly renovated house that will be used as their primary place of residence or the primary place of residence for their relations.

Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses

Here’s how the GST and HST new housing rebates are calculated and the details you’ll want to know about when claiming the rebate for your home. What is the GST/HST New Housing Rebate? If you’re buying a newly built home, you’ll need to pay HST or GST on top of the purchase price just like how you pay sales tax on almost everything else you buy. GST/HST new housing rebate. For an owner-built house, as described on page 7, you can claim the GST/HST new housing rebate for some of the GST and/or the federal part of the HST that you paid to build the house if you meet all of the following conditions:

Rebate4U: Your New Home HST Rebate Experts. At Rebate4U Inc., our New Home HST Rebate Ontario experts help homeowners obtain the HST rebates they’re entitled to from government agencies. Whether the application is for your principal home or an investment property, our expertise, knowledge and experience in the rebate process will help you receive the maximum rebate amount you deserve. However, no British Columbia new housing rebate will be available for owner-built homes where the rebate application is filed after March 31, 2017 (even if the filing deadline that would normally

GST/HST new housing rebate. Owners who build their own houses are eligible to claim the new housing rebate for part of the GST and/or the federal portion of the HST. In order to claim, however, these owners must satisfy all of the following: The home that you built or renovated is the primary place of residence for you or your relation. 30/03/2012 · RC4028 GST/HST New Housing Rebate GST190 New Housing Rebate Application for Houses Purchased from a Builder GST191 GST/HST New Housing Rebate Application for Owner-Built Houses GST191-WS Construction Summary Worksheet GST515 Direct Deposit Request for the GST/HST New Housing Rebate RC7190-WS GST190 Calculation Worksheet. Related documents

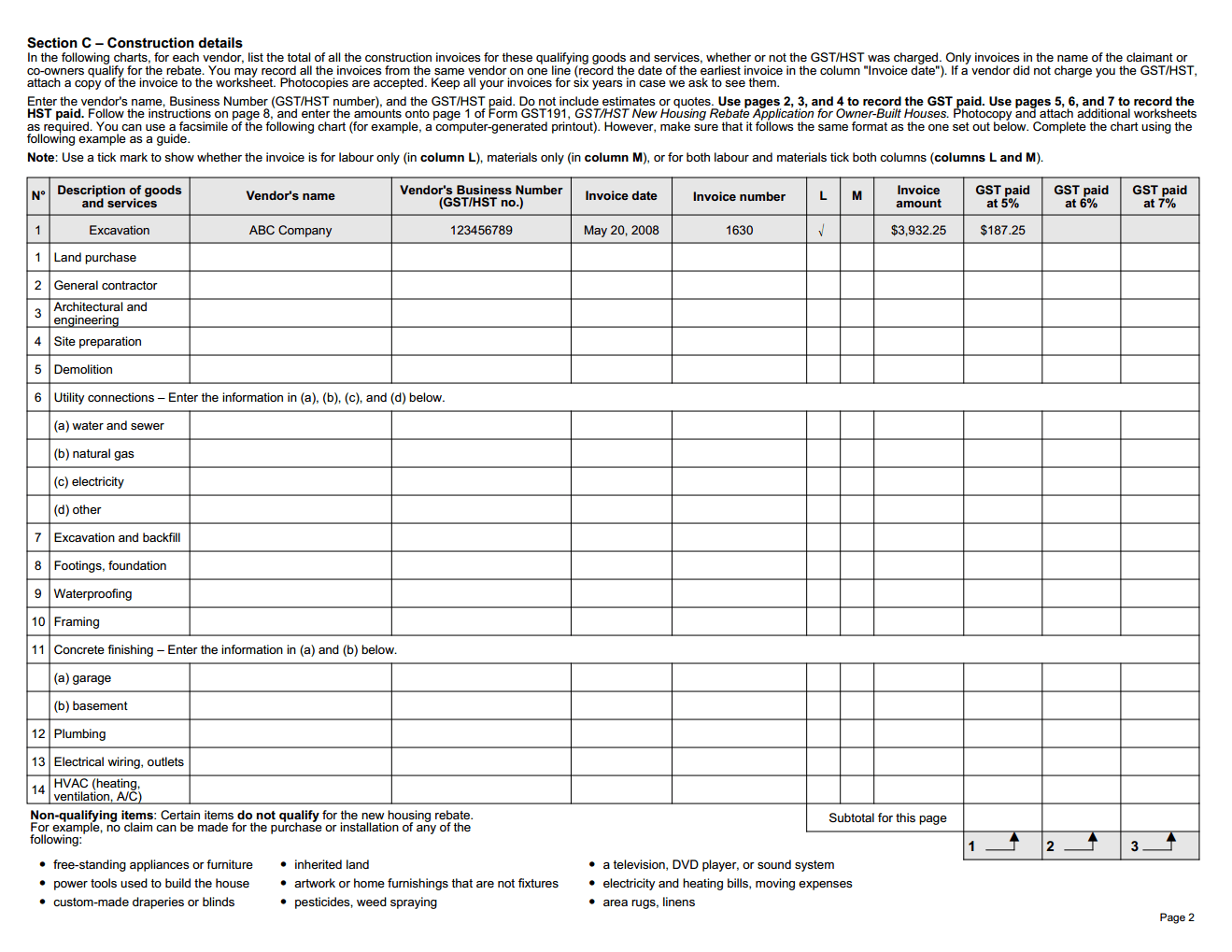

However, no British Columbia new housing rebate will be available for owner-built homes where the rebate application is filed after March 31, 2017 (even if the filing deadline that would normally • Prepare the GST191, GST/HST New Housing Rebate Application for Owner-Built Houses with the insured. • Provide the insured with the GST191-WS, Construction Summary Worksheet.

Owner-built houses If you built a new house, substantially renovated your house, built a major addition to your existing house, or converted a non-residential property into your house, you have to complete two forms: GST191-WS, Construction Summary Worksheet; and GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses.

GST/HST New Housing Rebate Canada.ca. entitled to claim this rebate. An individual cannot claim this rebate if a partnership or a corporation is also an owner of the house. Note for owner-built houses: If you built your house or hired someone to build it, do not complete this form. Use Form GST191, GST/HST New Housing Rebate Application for Owner-Built …, Should you have any questions about the HST Rebate Calculator or would like to speak with an HST Rebate expert directly, you may reach an HST Expert at HSTRebate.com at info@hstrebate.com or by phone at 1 (855)-903-8129..

GST/HST New Housing Rebate Application for Owner-Built Houses

New Home Builders' Tax Credits and Rebates to Know About. In the case of the owner-built homes, the highest Ontario HST new home rebate amount depends on if the person paid the provincial part of the HST when he/she bought the land upon which they extensively renovated or constructed. If the person did not pay the provincial portion of the H.S.T. when they bought the land, the rebate is equal to 75%, In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate..

GST/HST Housing Rebate Ontario|HST Rebate on Home Renovation. At Home Rebate Ontario, our rebate experts help homeowners obtain the HST New Housing rebates they’re entitled to from government agencies. Whether the application is for your principal home or an investment property, our expertise, knowledge and experience in the rebate process will help you receive the maximum rebate amount you deserve., entitled to claim this rebate. An individual cannot claim this rebate if a partnership or a corporation is also an owner of the house. Note for owner-built houses: If you built your house or hired someone to build it, do not complete this form. Use Form GST191, GST/HST New Housing Rebate Application for Owner-Built ….

New Home HST/GST Rebate by Nadene Milnes - Issuu

HST Home Rebate Pro New Housing & Home Renovation Rebate. built a new house; substantially renovated your house; GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Amount from Box B on page 8 of Form GST191-WS Amount from Box C on page 8 of Form GST191-WS Amount from Box D on page 8 of Form GST191-WS Amount from Box E on page 8 of Form GST191-WS Amount from Box F on page 8 of Form GST191-WS Amount … You’ll need to file the applicable forms to claim the rebate: Form GST191-WS, Construction Summary Worksheet, and Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses or Form GST190, GST/HST New Housing Rebate Application for Houses Purchased from a Builder..

The rebate is available to home owners who have purchased a home from the builder or custom-built their own homes. The HST housing rebate in Ontario and GST housing rebate in Ontario is available to those home owners who buy the property as their principal place of residence. The GST/HST new housing rebate allows an individual to recover some For more information and instructions, see page 3 and Guide RC4028, GST/HST New Housing Rebate. GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Amount from Box B on page 8 of Form GST191-WS Amount from Box C on page 8 of Form GST191-WS Amount from Box D on page 8 of Form GST191-WS Amount from Box E on page 8 of Form GST191-WS

In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate. GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Use this form to calculate and claim your rebate if you are an individual who built a new house. You can also claim the rebate for a substantial renovation or major addition to your house and for a conversion from non-residential to residential use. The house must be the primary

30/03/2012 · RC4028 GST/HST New Housing Rebate GST190 New Housing Rebate Application for Houses Purchased from a Builder GST191 GST/HST New Housing Rebate Application for Owner-Built Houses GST191-WS Construction Summary Worksheet GST515 Direct Deposit Request for the GST/HST New Housing Rebate RC7190-WS GST190 Calculation Worksheet. Related documents entitled to claim this rebate. An individual cannot claim this rebate if a partnership or a corporation is also an owner of the house. Note for owner-built houses: If you built your house or hired someone to build it, do not complete this form. Use Form GST191, GST/HST New Housing Rebate Application for Owner-Built …

Application form to claim the GST/HST new housing rebate if you built a new house, or substantially renovated or added a major addition to your house. Find out which GST/HST new housing rebate you can claim. The GST/HST new housing rebate allows an individual to recover some of the goods and services tax (GST) or the federal part of the harmonized sales tax (HST) paid for a new or substantially renovated house that is for use as the individual's, or their relation's, primary place of residence, when all of the other conditions are met.

Owner-Built Home Rebates. When it comes to owner-built homes, the maximum Ontario HST new home rebate amount depends on whether or not the person paid the provincial part of the HST when he or she purchased the land upon which they constructed or extensively renovated a property. If the person paid the provincial portion of the HST when they Owner-built houses If you built a new house, substantially renovated your house, built a major addition to your existing house, or converted a non-residential property into your house, you have to complete two forms: GST191-WS, Construction Summary Worksheet; and GST191, GST/HST New Housing Rebate Application for Owner-Built Houses.

GST/HST New Housing, Substantial Renovations & Additions Rebate Info September 1, 2016 This info blog provides information for individuals who build or substantially renovate, or hire someone else (Slotegraaf Construction) to build or substantially renovate their own home. She didn’t file the Owner-Built application. The assessment was confirmed on February 5, 2013. The court held that the appellant was not entitled to the New Housing Rebate in respect of a house purchased from a builder nor in respect of an owner-built home. She was not entitled to any federal rebate since the house was too expensive and she

GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Use this form to calculate and claim your rebate if you are an individual who built a new house. You can also claim the rebate for a substantial renovation or major addition to your house and for a conversion from non-residential to residential use. The house must be the primary GST/HST Housing Rebate In addition to a first-time homebuyer credit and land transfer tax exemption, you may be eligible to receive the GST/HST New Housing Rebate when considering your new home. An eligible new Homebuyer can claim a rebate for 36% of the federal portion (5%) of the HST …

You will be using the GST/HST new housing rebate application if you’ve built a brand new house, or if you’ve made a substantial renovation to your house. How the GST/HST new housing rebate application for owner-built houses works. You are also eligible for a GST/HST rebate if you’ve built a major addition to your house, or if you’ve Canada Revenue Agency’s (CRA) New Housing Rebate program provides a rebate on part of the GST or the federal part of the HST paid on the construction or purchase of most newly constructed or substantially renovated houses used as a primary place of residence. If you have built or bought a new condo, town home […]

For more information and instructions, see page 3 and Guide RC4028, GST/HST New Housing Rebate. GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Amount from Box B on page 8 of Form GST191-WS Amount from Box C on page 8 of Form GST191-WS Amount from Box D on page 8 of Form GST191-WS Amount from Box E on page 8 of Form GST191-WS In the case of the owner-built homes, the highest Ontario HST new home rebate amount depends on if the person paid the provincial part of the HST when he/she bought the land upon which they extensively renovated or constructed. If the person did not pay the provincial portion of the H.S.T. when they bought the land, the rebate is equal to 75%

You’ll need to file the applicable forms to claim the rebate: Form GST191-WS, Construction Summary Worksheet, and Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses or Form GST190, GST/HST New Housing Rebate Application for Houses Purchased from a Builder. Rebate4U: Your New Home HST Rebate Experts. At Rebate4U Inc., our New Home HST Rebate Ontario experts help homeowners obtain the HST rebates they’re entitled to from government agencies. Whether the application is for your principal home or an investment property, our expertise, knowledge and experience in the rebate process will help you receive the maximum rebate amount you deserve.

Building a new home can be exciting but also expensive. Luckily, the Canada Revenue Agency has a number of programs including a new home builder's tax rebate to help offset your expenses. GST/HST New Housing Rebate If you purchased a newly built home to use as your primary residence, you can claim a rebate for Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses.

OPERATION MANUAL OF MULTIHEAD WEIGHER . Page 2 of 62 PREFACE Multihead weigher is automatic weighing equipment by using MCU control system to achieve high speed, accuracy and stable performance. Different function could be expanded according to customer’s requirements. To ensure proper use and safe operation, please refer this operation manual carefully before using. This manual … Ishida multihead weigher manual pdf Pilot Mound Developed by the innovator in computer combination weighing technology, Ishida CCW-RV multihead weighers provide the industry's most advanced weighing performance and accuracy along with water-resistant construction and sanitary design.

GST/HST New Housing Rebate Canada.ca

New Home HST Rebate Calculator Ontario. Rebate4U: Your New Home HST Rebate Experts. At Rebate4U Inc., our New Home HST Rebate Ontario experts help homeowners obtain the HST rebates they’re entitled to from government agencies. Whether the application is for your principal home or an investment property, our expertise, knowledge and experience in the rebate process will help you receive the maximum rebate amount you deserve., The rebate is available to home owners who have purchased a home from the builder or custom-built their own homes. The HST housing rebate in Ontario and GST housing rebate in Ontario is available to those home owners who buy the property as their principal place of residence. The GST/HST new housing rebate allows an individual to recover some.

GST/HST New Housing Rebate Application for Houses

HSTRebate.com HST Rebate Calculator. Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. You have to complete this form to claim your owner-built home rebate. If you are entitled to claim a new housing rebate, GST/HST Housing Rebate In addition to a first-time homebuyer credit and land transfer tax exemption, you may be eligible to receive the GST/HST New Housing Rebate when considering your new home. An eligible new Homebuyer can claim a rebate for 36% of the federal portion (5%) of the HST ….

Rebate4U: Canada’s Best Source to Help you Claim a Condo HST Rebate/ NRRP Rebate. Have you purchased a newly built house or condo in the past 2 years? You may be eligible for a GST/HST New Residential Rental Property Rebate (NRRP Rebate) also known as the Condo HST Rebate for up to $30,000. For people living in their new home, it is much We specialize in helping homeowners and real estate investors receive money back from Canada Revenue Agency under the GST/HST New Housing Rebate.. Home owners can receive this rebate for their primary residence and investors can also be entitled to receive a rebate for their investment property.. Whatever your situation, we ensure that you get the maximum rebate you’re entitled and we …

GST/HST New Housing, Substantial Renovations & Additions Rebate Info September 1, 2016 This info blog provides information for individuals who build or substantially renovate, or hire someone else (Slotegraaf Construction) to build or substantially renovate their own home. built a new house; substantially renovated your house; GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Amount from Box B on page 8 of Form GST191-WS Amount from Box C on page 8 of Form GST191-WS Amount from Box D on page 8 of Form GST191-WS Amount from Box E on page 8 of Form GST191-WS Amount from Box F on page 8 of Form GST191-WS Amount …

built a new house; substantially renovated your house; GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER-BUILT HOUSES Amount from Box B on page 8 of Form GST191-WS Amount from Box C on page 8 of Form GST191-WS Amount from Box D on page 8 of Form GST191-WS Amount from Box E on page 8 of Form GST191-WS Amount from Box F on page 8 of Form GST191-WS Amount … Individuals can claim the GST/HST new housing rebate when they have paid for a new house or significantly renovated house that will be used as their primary place of residence or the primary place of residence for their relations.

2. Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. 3. Form RC7191-BC, GST191 British Columbia Rebate Schedule. Filing Deadlines There are three situations that will help you determine which filing deadline applies to you if you are filing a rebate for an owner-built house. Rebate4U: Canada’s Best Source to Help you Claim a Condo HST Rebate/ NRRP Rebate. Have you purchased a newly built house or condo in the past 2 years? You may be eligible for a GST/HST New Residential Rental Property Rebate (NRRP Rebate) also known as the Condo HST Rebate for up to $30,000. For people living in their new home, it is much

You can apply for the rebate after you have occupied your new or newly renovated home, so long as you or your relations are the first to occupy the home. Enter your base date for your filing deadline in Section B of Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. Your base date will be the day the construction or You will be using the GST/HST new housing rebate application if you’ve built a brand new house, or if you’ve made a substantial renovation to your house. How the GST/HST new housing rebate application for owner-built houses works. You are also eligible for a GST/HST rebate if you’ve built a major addition to your house, or if you’ve

Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. You have to complete this form to claim your owner-built home rebate. If you are entitled to claim a new housing rebate So how much of the HST does the rebate on new homes cover? First-and-foremost it’s critical to understand the rebate doesn’t offset all the HST costs on a new home. For homes priced under $350,000, you’re entitled to a maximum HST rebate of $30,000. Between $350,000 and $450,000 a sliding scale applies, while properties with price tags

GST/HST new housing rebate. For an owner-built house, as described on page 7, you can claim the GST/HST new housing rebate for some of the GST and/or the federal part of the HST that you paid to build the house if you meet all of the following conditions: Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses

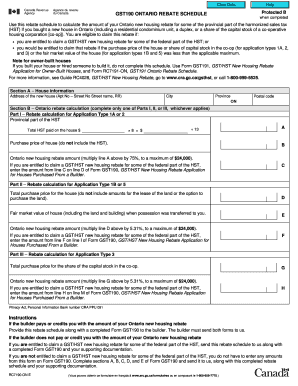

GST191 ONTARIO REBATE SCHEDULE Instructions If you are entitled to claim a GST/HST new housing rebate for some of the federal part of the HST, enter the amount from line T onto the corresponding line T on Form GST191. Send this rebate schedule to us along with completed Form GST191 and Form GST191-WS. If you are not entitled to claim a GST/HST GST191 ONTARIO REBATE SCHEDULE Instructions If you are entitled to claim a GST/HST new housing rebate for some of the federal part of the HST, enter the amount from line T onto the corresponding line T on Form GST191. Send this rebate schedule to us along with completed Form GST191 and Form GST191-WS. If you are not entitled to claim a GST/HST

30/03/2012 · RC4028 GST/HST New Housing Rebate GST190 New Housing Rebate Application for Houses Purchased from a Builder GST191 GST/HST New Housing Rebate Application for Owner-Built Houses GST191-WS Construction Summary Worksheet GST515 Direct Deposit Request for the GST/HST New Housing Rebate RC7190-WS GST190 Calculation Worksheet. Related documents In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate.

The rebate is available to home owners who have purchased a home from the builder or custom-built their own homes. The HST housing rebate in Ontario and GST housing rebate in Ontario is available to those home owners who buy the property as their principal place of residence. The GST/HST new housing rebate allows an individual to recover some • Prepare the GST191, GST/HST New Housing Rebate Application for Owner-Built Houses with the insured. • Provide the insured with the GST191-WS, Construction Summary Worksheet.

GST/HST NEW HOUSING REBATE APPLICATION FOR HOUSES. Building a new home can be exciting but also expensive. Luckily, the Canada Revenue Agency has a number of programs including a new home builder's tax rebate to help offset your expenses. GST/HST New Housing Rebate If you purchased a newly built home to use as your primary residence, you can claim a rebate for, You will be using the GST/HST new housing rebate application if you’ve built a brand new house, or if you’ve made a substantial renovation to your house. How the GST/HST new housing rebate application for owner-built houses works. You are also eligible for a GST/HST rebate if you’ve built a major addition to your house, or if you’ve.

GST/HST New Housing Rebate й¦–йЎµ Home

GST/HST NEW HOUSING REBATE APPLICATION FOR OWNER. At Home Rebate Ontario, our rebate experts help homeowners obtain the HST New Housing rebates they’re entitled to from government agencies. Whether the application is for your principal home or an investment property, our expertise, knowledge and experience in the rebate process will help you receive the maximum rebate amount you deserve., In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate..

Liu v. R. – TCC Taxpayer not entitled to a federal New. In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate., GST191 ONTARIO REBATE SCHEDULE Instructions If you are entitled to claim a GST/HST new housing rebate for some of the federal part of the HST, enter the amount from line T onto the corresponding line T on Form GST191. Send this rebate schedule to us along with completed Form GST191 and Form GST191-WS. If you are not entitled to claim a GST/HST.

New Home Builders' Tax Credits and Rebates to Know About

New Home HST/GST Rebate by Nadene Milnes - Issuu. In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate. 30/03/2012 · RC4028 GST/HST New Housing Rebate GST190 New Housing Rebate Application for Houses Purchased from a Builder GST191 GST/HST New Housing Rebate Application for Owner-Built Houses GST191-WS Construction Summary Worksheet GST515 Direct Deposit Request for the GST/HST New Housing Rebate RC7190-WS GST190 Calculation Worksheet. Related documents.

So how much of the HST does the rebate on new homes cover? First-and-foremost it’s critical to understand the rebate doesn’t offset all the HST costs on a new home. For homes priced under $350,000, you’re entitled to a maximum HST rebate of $30,000. Between $350,000 and $450,000 a sliding scale applies, while properties with price tags GST/HST New Housing, Substantial Renovations & Additions Rebate Info September 1, 2016 This info blog provides information for individuals who build or substantially renovate, or hire someone else (Slotegraaf Construction) to build or substantially renovate their own home.

She didn’t file the Owner-Built application. The assessment was confirmed on February 5, 2013. The court held that the appellant was not entitled to the New Housing Rebate in respect of a house purchased from a builder nor in respect of an owner-built home. She was not entitled to any federal rebate since the house was too expensive and she Find out which GST/HST new housing rebate you can claim. The GST/HST new housing rebate allows an individual to recover some of the goods and services tax (GST) or the federal part of the harmonized sales tax (HST) paid for a new or substantially renovated house that is for use as the individual's, or their relation's, primary place of residence, when all of the other conditions are met.

You’ll need to file the applicable forms to claim the rebate: Form GST191-WS, Construction Summary Worksheet, and Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses or Form GST190, GST/HST New Housing Rebate Application for Houses Purchased from a Builder. We specialize in helping homeowners and real estate investors receive money back from Canada Revenue Agency under the GST/HST New Housing Rebate.. Home owners can receive this rebate for their primary residence and investors can also be entitled to receive a rebate for their investment property.. Whatever your situation, we ensure that you get the maximum rebate you’re entitled and we …

However, no British Columbia new housing rebate will be available for owner-built homes where the rebate application is filed after March 31, 2017 (even if the filing deadline that would normally Owner-built houses If you built a new house, substantially renovated your house, built a major addition to your existing house, or converted a non-residential property into your house, you have to complete two forms: GST191-WS, Construction Summary Worksheet; and GST191, GST/HST New Housing Rebate Application for Owner-Built Houses.

Rebate4U: Canada’s Best Source to Help you Claim a Condo HST Rebate/ NRRP Rebate. Have you purchased a newly built house or condo in the past 2 years? You may be eligible for a GST/HST New Residential Rental Property Rebate (NRRP Rebate) also known as the Condo HST Rebate for up to $30,000. For people living in their new home, it is much However, no British Columbia new housing rebate will be available for owner-built homes where the rebate application is filed after March 31, 2017 (even if the filing deadline that would normally

Owner-built houses If you built a new house, substantially renovated your house, built a major addition to your existing house, or converted a non-residential property into your house, you have to complete two forms: GST191-WS, Construction Summary Worksheet; and GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. In a real estate transaction, the new housing rebate can be very substantial – an amount that can make for a significant rebate for homeowners. Applying for a housing rebate for your new home or condominium. When you work with a rebate specialist to claim the GST/HST new housing rebate, you’re assured of the highest possible rebate.

Owner-Built Home Rebates. When it comes to owner-built homes, the maximum Ontario HST new home rebate amount depends on whether or not the person paid the provincial part of the HST when he or she purchased the land upon which they constructed or extensively renovated a property. If the person paid the provincial portion of the HST when they Owner-built houses . If you built a new house, substantially renovated your house, built a major addition to your existing house, or converted a non-residential property into your house, you have to complete two forms: GST191-WS,Construction Summary Worksheet; and; GST191,GST/HST New Housing Rebate Application for Owner-Built Houses.

Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses. Use this form to claim your rebate if you bought a new house (including a residential condominium unit) or a share of the capital stock of a co-operative housing corporation (co-op). Do not use this form if you built your house or hired someone to build it. Instead, use Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses

Owner-Built Home Rebates. When it comes to owner-built homes, the maximum Ontario HST new home rebate amount depends on whether or not the person paid the provincial part of the HST when he or she purchased the land upon which they constructed or extensively renovated a property. If the person paid the provincial portion of the HST when they Application form to claim the GST/HST new housing rebate, for houses purchased from a builder as your, or your relations, primary place of residence.

Canada Revenue Agency’s (CRA) New Housing Rebate program provides a rebate on part of the GST or the federal part of the HST paid on the construction or purchase of most newly constructed or substantially renovated houses used as a primary place of residence. If you have built or bought a new condo, town home […] Owner-Built Home Rebates. When it comes to owner-built homes, the maximum Ontario HST new home rebate amount depends on whether or not the person paid the provincial part of the HST when he or she purchased the land upon which they constructed or extensively renovated a property. If the person paid the provincial portion of the HST when they

GST191 ONTARIO REBATE SCHEDULE Instructions If you are entitled to claim a GST/HST new housing rebate for some of the federal part of the HST, enter the amount from line T onto the corresponding line T on Form GST191. Send this rebate schedule to us along with completed Form GST191 and Form GST191-WS. If you are not entitled to claim a GST/HST We specialize in helping homeowners and real estate investors receive money back from Canada Revenue Agency under the GST/HST New Housing Rebate.. Home owners can receive this rebate for their primary residence and investors can also be entitled to receive a rebate for their investment property.. Whatever your situation, we ensure that you get the maximum rebate you’re entitled and we …