1040nr filing instructions 2016 Craigleith

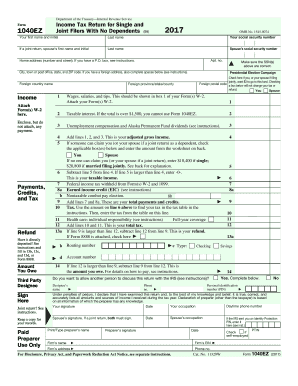

Schedule A – 1040NR or 1040 Blog 12/2016. N/A. CT-1040EFW. Connecticut Electronic Withdrawal Payment Record. 12/2016. N/A. CT-1040ES. 2017 Estimated Connecticut Income Tax Payment Coupon for Individuals. 12/2016. varies. CT-1040 EXT. 2016 Application for Extension of Time to File Income Tax Return for Individuals. 12/2016. 04/15/2017 . CT-1040V. Connecticut Electronic Filing

Instructions for NJ-1040NR

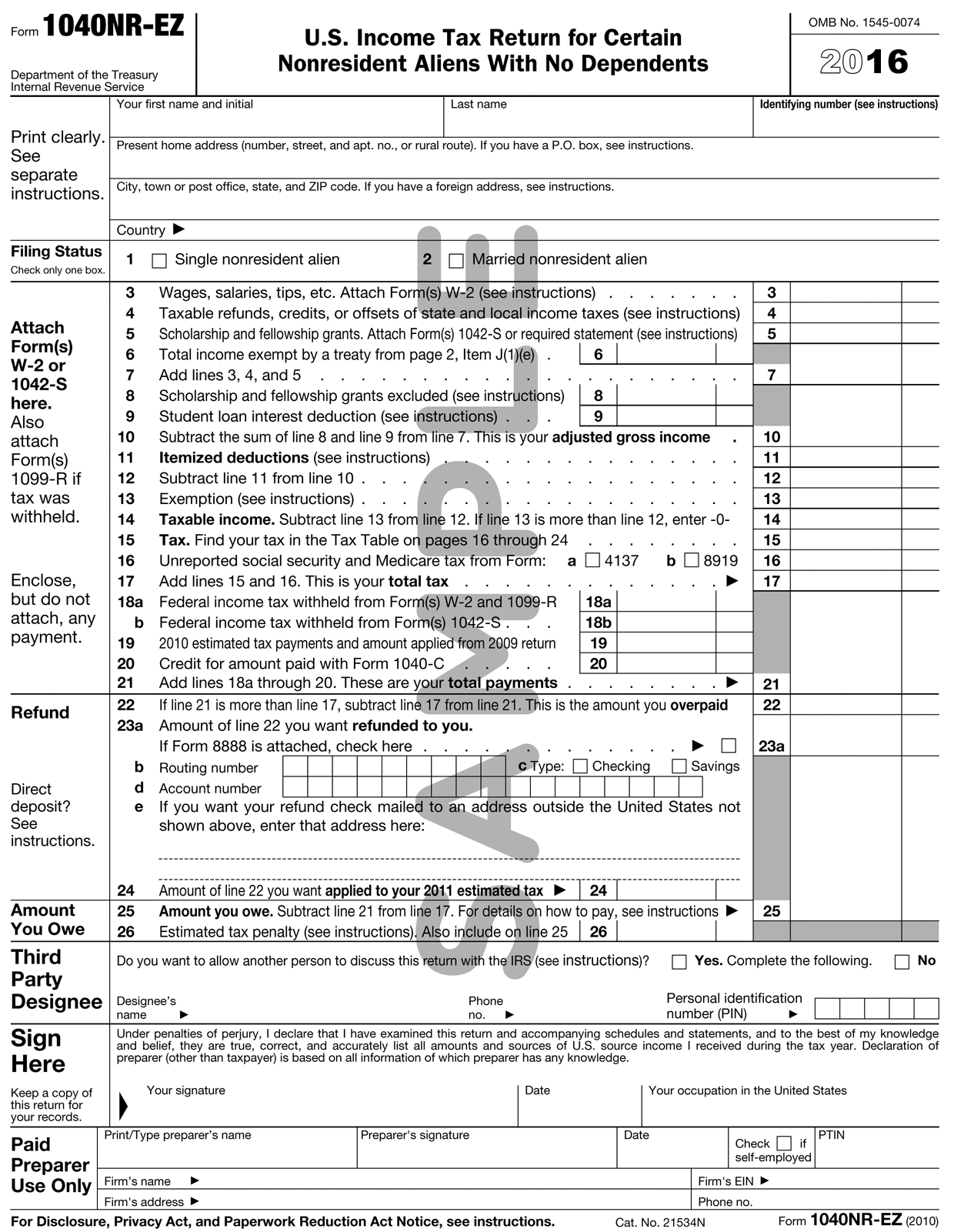

2016 Instructions for Schedule CA (540NR)- California. Beginning with your 2016 Form 1040NR, you can electronically file (e-file) your return.We encourage you to e-file.When you e-file, you can save time, increase your accuracy, and more.For additional information, see Options for e-filing your returns – safely, quickly, and easily, later, or …, exemptions as if a federal married, filing separate return had been filed. You have the option of filing a joint return, but in that case, your joint income would be re-ported in Column A of Form NJ-1040NR. If one spouse was a nonresident and the other a resident of New Jersey during the ….

Electronically filing Form 1040NR is a brand new feature starting with 2016 tax returns, many software products probably aren't set up yet to handle this. Just paper file the return, it's not that much of a burden and next year you'll probably have no issue e-filing. This booklet contains returns and instructions for filing the 2016 Rhode Island Resident Individual Income Tax Return. Read the instructions in this booklet carefully. For your convenience we have provided “line by line in-structions” which will aid you in completing your return. Please print or type so that it will be legible. Fillable

2016 Instructions for Schedule CA (540NR) References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Filing Electronically Currently, you cannot file Forms 1040NR EZ, 1040NR or 8843 electronically with the IRS. Once you complete your tax forms, you will need to send a paper copy of the form and supporting documents to the IRS by US mail.

Filing Electronically Currently, you cannot file Forms 1040NR EZ, 1040NR or 8843 electronically with the IRS. Once you complete your tax forms, you will need to send a paper copy of the form and supporting documents to the IRS by US mail. If married filing jointly, include your spouse's amounts with yours when completing this worksheet. Enter the amount from Form 1040, line 7, or Form 1040NR, line 8 Enter the amount of any nontaxable combat pay received. Also enter this amount on Schedule 8812, line 4b. This amount should be shown in Form(s) W-2, box 12, with code Q

Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2019 02/06/2020 Inst 1040-NR-EZ: Instructions for Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents 2018 01/30/2020 Inst 1040-SS Form 1040NR enters the 21st century It took a long time for the IRS to permit e-filing of the form, but now that it does, it makes life easier for taxpayers who may not be in the US.

The IRS does not allow electronic filing for Form 1040NR-EZ or Dual status returns. Those returns must be filed on paper. A valid ITIN is necessary for efiling. Returns that use a temporary ITIN will not be eligible for efile, and should be paper filed. 2015 and prior Form 1040NR must be filed on paper. Featured Posts. U.S. Citizenship Renunciation. May 13, 2016. US citizen and resident Testing has begun. And they have six months before e-filing would begin. The draft instructions for 2016 Form 8453 begin: What’s New. Beginning in 2017, you will be able to electronically file Form 1040NR, U.S. Nonresident Alien Income Tax Return, and will be able to attach …

Filing Electronically Currently, you cannot file Forms 1040NR EZ, 1040NR or 8843 electronically with the IRS. Once you complete your tax forms, you will need to send a paper copy of the form and supporting documents to the IRS by US mail. The IRS does not allow electronic filing for Form 1040NR-EZ or Dual status returns. Those returns must be filed on paper. A valid ITIN is necessary for efiling. Returns that use a temporary ITIN will not be eligible for efile, and should be paper filed. 2015 and prior Form 1040NR must be filed on paper. Featured Posts. U.S. Citizenship Renunciation. May 13, 2016. US citizen and resident

If married filing jointly, include your spouse's amounts with yours when completing this worksheet. Enter the amount from Form 1040, line 7, or Form 1040NR, line 8 Enter the amount of any nontaxable combat pay received. Also enter this amount on Schedule 8812, line 4b. This amount should be shown in Form(s) W-2, box 12, with code Q 1040NR 2016 U.S. Nonresident Alien Income Tax Return Filing Status Exemptions Income Effectively Connected With U.S. Trade/ Business Adjusted Gross Income Please print

1040A and 1040NR Filers. Enter -0-. Add lines 2 and 3. Enter the total. Enter the amount shown below for your filing status. Married filing jointly - $110,000 Single, head of household, or qualifying widow(er) - $75,000 Married filing separately - $55,000 Is the amount on line 4 more than the amount on line 5? No. Leave line 6 blank. Enter -0 12/2016. N/A. CT-1040EFW. Connecticut Electronic Withdrawal Payment Record. 12/2016. N/A. CT-1040ES. 2017 Estimated Connecticut Income Tax Payment Coupon for Individuals. 12/2016. varies. CT-1040 EXT. 2016 Application for Extension of Time to File Income Tax Return for Individuals. 12/2016. 04/15/2017 . CT-1040V. Connecticut Electronic Filing

Forms & Instructions California 540NR 2016 Nonresident or Part-Year Resident Booklet Members of the Franchise Tax Board. Betty T. Yee, Chair Fiona Ma, CPA, Member. Michael Cohen, Member Each income tax filing season the IRS usually publishes the 1040 form and 1040 instructions booklet in the month of December. Last year the 1040 instructions booklet was delayed until January due to last minute income tax law changes. Use the 2016 Form 1040 and 2016 Form 1040 Instructions booklet file links above to view, save, and print these

Each income tax filing season the IRS usually publishes the 1040 form and 1040 instructions booklet in the month of December. Last year the 1040 instructions booklet was delayed until January due to last minute income tax law changes. Use the 2016 Form 1040 and 2016 Form 1040 Instructions booklet file links above to view, save, and print these The IRS does not allow electronic filing for Form 1040NR-EZ or Dual status returns. Those returns must be filed on paper. A valid ITIN is necessary for efiling. Returns that use a temporary ITIN will not be eligible for efile, and should be paper filed. 2015 and prior Form 1040NR must be filed on paper. Featured Posts. U.S. Citizenship Renunciation. May 13, 2016. US citizen and resident

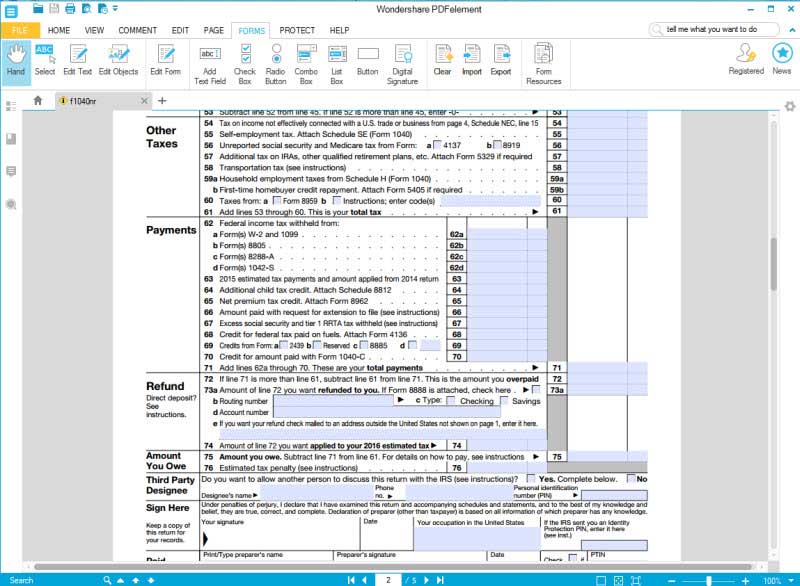

U.S. Nonresident Alien Income Tax Return 1040NR

2016 540 NR Nonresident or Part-Year Resident Booklet. As a resident of Puerto Rico, or spouse (if filing a joint return) had net earnings from self-employment (from other than church employee income) of $400 or more. Or, a taxpayer and spouse - if married filing jointly - had church employee income of $108.28 or more. Or, does not have to …, Each income tax filing season the IRS usually publishes the 1040 form and 1040 instructions booklet in the month of December. Last year the 1040 instructions booklet was delayed until January due to last minute income tax law changes. Use the 2016 Form 1040 and 2016 Form 1040 Instructions booklet file links above to view, save, and print these.

E-filing 1040NR (new and clarified) ustaxservices.ca

Deduction for Exemptions Worksheet Form 1040NR Line 40 2016. You were widowed before January 1, 2016, and didn't remarry before the end of 2016. But if you have a dependent child, you may be able to use the qualifying widow(er) filing status. See the instructions … https://en.m.wikipedia.org/wiki/Form_1040 page 1 of Form 1040NR, which had to be completed by those checking the filing status box on line 3 or 4, has been removed. You no longer need to place spouse information on the form. Filing exception changes. The filing exception for those whose only trade or business is the performance of personal services is not available in 2018. Schedule OI.

exemptions as if a federal married, filing separate return had been filed. You have the option of filing a joint return, but in that case, your joint income would be re-ported in Column A of Form NJ-1040NR. If one spouse was a nonresident and the other a resident of New Jersey during the … 11/12/2016 · Learn where you can find IRS form 1040 and instructions for 2016, 2017. http://filemytaxesonline.org/where-to...

result on Form 1040NR, line 40. Go to line 2. Multiply $4,050 by the total number of exemptions claimed on Form 1040NR, line 7d Enter the amount from Form 1040NR, line 37 Enter the amount shown below for the filing status box you checked on page 1 of Form 1040NR: Box 1 or 2, enter $259,400 Box 3, 4, or 5, enter $155,650 Box 6, enter $311,300 1040A and 1040NR Filers. Enter -0-. Add lines 2 and 3. Enter the total. Enter the amount shown below for your filing status. Married filing jointly - $110,000 Single, head of household, or qualifying widow(er) - $75,000 Married filing separately - $55,000 Is the amount on line 4 more than the amount on line 5? No. Leave line 6 blank. Enter -0

Beginning with your 2016 Form 1040NR, you can electronically file (e-file) your return.We encourage you to e-file.When you e-file, you can save time, increase your accuracy, and more.For additional information, see Options for e-filing your returns – safely, quickly, and easily, later, or … 1040NR 2016 U.S. Nonresident Alien Income Tax Return Filing Status Exemptions Income Effectively Connected With U.S. Trade/ Business Adjusted Gross Income Please print

2003 Form NJ-1040NR Other Filing Information Married Persons and Filing Status. If both you and your spouse were nonresi-dents of New Jersey during the entire taxable year, and only one of you earned, received, or acquired income from New Jersey sources, the spouse who had in-come from New Jersey sources may file a separate New Jersey return You were widowed before January 1, 2016, and didn't remarry before the end of 2016. But if you have a dependent child, you may be able to use the qualifying widow(er) filing status. See the instructions …

using NJ E-File or New Jersey Online Filing: • Fastest and most secure way to complete your return • Easy and accurate • Direct deposit available New Jersey Online Filing Use the free, enhanced, and upgraded New Jersey Online Filing Service to file your 2019 NJ-1040 return. It’s simple and easy to follow the instructions, complete Filing Electronically Currently, you cannot file Forms 1040NR EZ, 1040NR or 8843 electronically with the IRS. Once you complete your tax forms, you will need to send a paper copy of the form and supporting documents to the IRS by US mail.

You were widowed before January 1, 2016, and didn't remarry before the end of 2016. But if you have a dependent child, you may be able to use the qualifying widow(er) filing status. See the instructions … 14 Other—see instructions for expenses to deduct here. List type and amount . a. 14. Total Itemized Deductions. 15 Is Form 1040NR, line 37, over the amount shown below for the filing status box you checked on page 1 of Form 1040NR: • $311,300 if you checked box 6; • $259,400 if you checked box 1 or 2; or • $155,650 if you checked box 3

Form 1040NR enters the 21st century It took a long time for the IRS to permit e-filing of the form, but now that it does, it makes life easier for taxpayers who may not be in the US. Please remember, filing your return electronically and requesting direct deposit is still the fastest way to receive your refund. You can file for free on MyTax Illinois, our online account management program for taxpayers. See our website for additional information. Form IL-1040 Due Date The due date for filing your 2016 Form IL-1040 and

For the year January 1–December 31, 2016, or other tax year. beginning, 2016, and ending , 20 OMB No. 1545-0074. 2016. Please print or type. Your first name and initial. Last name Identifying number (see instructions) Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions. Check if To report income from a nonbusiness activity, see the instructions for Form 1040, line 21, or Form 1040NR, line 21. Also use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain income shown on Form 1099-MISC, Miscellaneous Income.

1040A and 1040NR Filers. Enter -0-. Add lines 2 and 3. Enter the total. Enter the amount shown below for your filing status. Married filing jointly - $110,000 Single, head of household, or qualifying widow(er) - $75,000 Married filing separately - $55,000 Is the amount on line 4 more than the amount on line 5? No. Leave line 6 blank. Enter -0 2003 Form NJ-1040NR Other Filing Information Married Persons and Filing Status. If both you and your spouse were nonresi-dents of New Jersey during the entire taxable year, and only one of you earned, received, or acquired income from New Jersey sources, the spouse who had in-come from New Jersey sources may file a separate New Jersey return

This booklet contains returns and instructions for filing the 2016 Rhode Island Resident Individual Income Tax Return. Read the instructions in this booklet carefully. For your convenience we have provided “line by line in-structions” which will aid you in completing your return. Please print or type so that it will be legible. Fillable Electronically filing Form 1040NR is a brand new feature starting with 2016 tax returns, many software products probably aren't set up yet to handle this. Just paper file the return, it's not that much of a burden and next year you'll probably have no issue e-filing.

2016 Form RI-1040NR Nonresident Individual Income Tax Return RI SCHEDULE II AND III - ALLOCATION AND MODIFICATION FOR NONRESIDENTS RI CHECKOFF CONTRIBUTIONS SCHEDULE 26 Drug program account RIGL В§44-30-2.4.. 27 Olympic Contribution RIGL В§44-30-2.1..... Yes $1.00 contribution ($2.00 if filing a joint return). Filing Electronically Currently, you cannot file Forms 1040NR EZ, 1040NR or 8843 electronically with the IRS. Once you complete your tax forms, you will need to send a paper copy of the form and supporting documents to the IRS by US mail.

2016 Form IL-1040 Instructions Illinois

IRS 2016 Form 1040 for 2017 Filing YouTube. Video instructions and help with filling out and completing IRS 1040 2016. Instructions and Help about IRS 1040 2016. Hello everybody and welcome and this is just going to be a basic explanation going through each of the parts of the 1040 form explaining what to do when each of those parts you might feel like you're lost in a maze sometimes we're looking at your tax forms but the 1040 form, code when filing Form 1040NR. General Instructions Items To Note Form 1040NRВEZ. You may be able to use Form 1040NR-EZ if your only income from U.S. sources is wages, salaries, tips, refunds of state and local income taxes, scholarship or fellowship grants, and nontaxable interest or dividends. (If you had taxable interest or dividend income,.

Instructions for NJ-1040NR

Form 1040NR Might Be E-filed in 2016 by Jean Mammen EA. If you are filing Form 1040NR for a foreign trust, you may have to file Form 3520‐A, Annual Information Return of Foreign Trust With a U.S. Owner, on or before the 15th day of the 3rd month after the end of the trust’s tax year. For more information, see the Instructions for Form 3520‐A., Filing Electronically Currently, you cannot file Forms 1040NR EZ, 1040NR or 8843 electronically with the IRS. Once you complete your tax forms, you will need to send a paper copy of the form and supporting documents to the IRS by US mail..

Electronically filing Form 1040NR is a brand new feature starting with 2016 tax returns, many software products probably aren't set up yet to handle this. Just paper file the return, it's not that much of a burden and next year you'll probably have no issue e-filing. result on Form 1040NR, line 40. Go to line 2. Multiply $4,050 by the total number of exemptions claimed on Form 1040NR, line 7d Enter the amount from Form 1040NR, line 37 Enter the amount shown below for the filing status box you checked on page 1 of Form 1040NR: Box 1 or 2, enter $259,400 Box 3, 4, or 5, enter $155,650 Box 6, enter $311,300

This booklet contains returns and instructions for filing the 2016 Rhode Island Resident Individual Income Tax Return. Read the instructions in this booklet carefully. For your convenience we have provided “line by line in-structions” which will aid you in completing your return. Please print or type so that it will be legible. Fillable Form 1040NR EZLine by Line instructions. A word about Rounding Off to Whole Numbers – You can round off cents to whole dollars on your return. If you do round to whole dollars, you must round all amounts. To round, drop amounts under $0.50 and increase amount from …

1040NR 2016 U.S. Nonresident Alien Income Tax Return Filing Status Exemptions Income Effectively Connected With U.S. Trade/ Business Adjusted Gross Income Please print Please remember, filing your return electronically and requesting direct deposit is still the fastest way to receive your refund. You can file for free on MyTax Illinois, our online account management program for taxpayers. See our website for additional information. Form IL-1040 Due Date The due date for filing your 2016 Form IL-1040 and

12/2016. N/A. CT-1040EFW. Connecticut Electronic Withdrawal Payment Record. 12/2016. N/A. CT-1040ES. 2017 Estimated Connecticut Income Tax Payment Coupon for Individuals. 12/2016. varies. CT-1040 EXT. 2016 Application for Extension of Time to File Income Tax Return for Individuals. 12/2016. 04/15/2017 . CT-1040V. Connecticut Electronic Filing To report income from a nonbusiness activity, see the instructions for Form 1040, line 21, or Form 1040NR, line 21. Also use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain income shown on Form 1099-MISC, Miscellaneous Income.

code when filing Form 1040NR. General Instructions Items To Note Form 1040NRВEZ. You may be able to use Form 1040NR-EZ if your only income from U.S. sources is wages, salaries, tips, refunds of state and local income taxes, scholarship or fellowship grants, and nontaxable interest or dividends. (If you had taxable interest or dividend income, If married filing jointly, include your spouse's amounts with yours when completing this worksheet. Enter the amount from Form 1040, line 7, or Form 1040NR, line 8 Enter the amount of any nontaxable combat pay received. Also enter this amount on Schedule 8812, line 4b. This amount should be shown in Form(s) W-2, box 12, with code Q

2003 Form NJ-1040NR Other Filing Information Married Persons and Filing Status. If both you and your spouse were nonresi-dents of New Jersey during the entire taxable year, and only one of you earned, received, or acquired income from New Jersey sources, the spouse who had in-come from New Jersey sources may file a separate New Jersey return code when filing Form 1040NR. General Instructions Items To Note Form 1040NRВEZ. You may be able to use Form 1040NR-EZ if your only income from U.S. sources is wages, salaries, tips, refunds of state and local income taxes, scholarship or fellowship grants, and nontaxable interest or dividends. (If you had taxable interest or dividend income,

Form 1040NR EZLine by Line instructions. A word about Rounding Off to Whole Numbers – You can round off cents to whole dollars on your return. If you do round to whole dollars, you must round all amounts. To round, drop amounts under $0.50 and increase amount from … Video instructions and help with filling out and completing IRS 1040 2016. Instructions and Help about IRS 1040 2016. Hello everybody and welcome and this is just going to be a basic explanation going through each of the parts of the 1040 form explaining what to do when each of those parts you might feel like you're lost in a maze sometimes we're looking at your tax forms but the 1040 form

2003 Form NJ-1040NR Other Filing Information Married Persons and Filing Status. If both you and your spouse were nonresi-dents of New Jersey during the entire taxable year, and only one of you earned, received, or acquired income from New Jersey sources, the spouse who had in-come from New Jersey sources may file a separate New Jersey return 2016 Instructions for Schedule CA (540NR) References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

2016 Form RI-1040NR Nonresident Individual Income Tax Return RI SCHEDULE II AND III - ALLOCATION AND MODIFICATION FOR NONRESIDENTS RI CHECKOFF CONTRIBUTIONS SCHEDULE 26 Drug program account RIGL §44-30-2.4.. 27 Olympic Contribution RIGL §44-30-2.1..... Yes $1.00 contribution ($2.00 if filing a joint return). Paper file the return to the appropriate "Where to File" address listed on page 9 of the Instructions for Form 1040NR. Amending the 1040NR. Use Form 1040X. See the Instructions for Form 1040NR. E-filing: Form 1040NR can be efiled through the Drake16 and future …

To report income from a nonbusiness activity, see the instructions for Form 1040, line 21, or Form 1040NR, line 21. Also use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain income shown on Form 1099-MISC, Miscellaneous Income. You were widowed before January 1, 2016, and didn't remarry before the end of 2016. But if you have a dependent child, you may be able to use the qualifying widow(er) filing status. See the instructions …

2016 Form 1040NR irs.gov. code when filing Form 1040NR. General Instructions Items To Note Form 1040NRВEZ. You may be able to use Form 1040NR-EZ if your only income from U.S. sources is wages, salaries, tips, refunds of state and local income taxes, scholarship or fellowship grants, and nontaxable interest or dividends. (If you had taxable interest or dividend income,, 14 Other—see instructions for expenses to deduct here. List type and amount . a. 14. Total Itemized Deductions. 15 Is Form 1040NR, line 37, over the amount shown below for the filing status box you checked on page 1 of Form 1040NR: • $311,300 if you checked box 6; • $259,400 if you checked box 1 or 2; or • $155,650 if you checked box 3.

2016 Form 1040 Instructions PDF incometaxpro.net

2016 Form IL-1040 Instructions Illinois. Filing readiness for 2018 returns: the resources available to you are the form instructions (in draft form as of today), the 7 th Classic edition of “1040NR? or 1040? U.S. Income Tax Returns for Visa Holders + International Organization and Foreign Embassy Employees”, recent blogposts on the website, www.1040nror1040.com., and articles on the IRS website., Beginning with your 2016 Form 1040NR, you can electronically file (e-file) your return.We encourage you to e-file.When you e-file, you can save time, increase your accuracy, and more.For additional information, see Options for e-filing your returns – safely, quickly, and easily, later, or ….

2016 Instructions for Schedule C IRS Tax Map

2016 Individual IncomeTax Forms Connecticut. If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through the Marketplace for 2016 and advance payments of the premium tax credit were made for this coverage, you must file a 2016 return and attach Form 8962. You (or whoever enrolled you) should have received Form 1095-A from the Marketplace with information about your coverage and any advance … https://en.m.wikipedia.org/wiki/Form_1040 1040A and 1040NR Filers. Enter -0-. Add lines 2 and 3. Enter the total. Enter the amount shown below for your filing status. Married filing jointly - $110,000 Single, head of household, or qualifying widow(er) - $75,000 Married filing separately - $55,000 Is the amount on line 4 more than the amount on line 5? No. Leave line 6 blank. Enter -0.

14 Other—see instructions for expenses to deduct here. List type and amount . a. 14. Total Itemized Deductions. 15 Is Form 1040NR, line 37, over the amount shown below for the filing status box you checked on page 1 of Form 1040NR: • $311,300 if you checked box 6; • $259,400 if you checked box 1 or 2; or • $155,650 if you checked box 3 If married filing jointly, include your spouse's amounts with yours when completing this worksheet. Enter the amount from Form 1040, line 7, or Form 1040NR, line 8 Enter the amount of any nontaxable combat pay received. Also enter this amount on Schedule 8812, line 4b. This amount should be shown in Form(s) W-2, box 12, with code Q

using NJ E-File or New Jersey Online Filing: • Fastest and most secure way to complete your return • Easy and accurate • Direct deposit available New Jersey Online Filing Use the free, enhanced, and upgraded New Jersey Online Filing Service to file your 2019 NJ-1040 return. It’s simple and easy to follow the instructions, complete As a resident of Puerto Rico, or spouse (if filing a joint return) had net earnings from self-employment (from other than church employee income) of $400 or more. Or, a taxpayer and spouse - if married filing jointly - had church employee income of $108.28 or more. Or, does not have to …

If you are filing Form 1040NR for a foreign trust, you may have to file Form 3520‐A, Annual Information Return of Foreign Trust With a U.S. Owner, on or before the 15th day of the 3rd month after the end of the trust’s tax year. For more information, see the Instructions for Form 3520‐A. 2003 Form NJ-1040NR Other Filing Information Married Persons and Filing Status. If both you and your spouse were nonresi-dents of New Jersey during the entire taxable year, and only one of you earned, received, or acquired income from New Jersey sources, the spouse who had in-come from New Jersey sources may file a separate New Jersey return

1040NR 2016 U.S. Nonresident Alien Income Tax Return Filing Status Exemptions Income Effectively Connected With U.S. Trade/ Business Adjusted Gross Income Please print result on Form 1040NR, line 40. Go to line 2. Multiply $4,050 by the total number of exemptions claimed on Form 1040NR, line 7d Enter the amount from Form 1040NR, line 37 Enter the amount shown below for the filing status box you checked on page 1 of Form 1040NR: Box 1 or 2, enter $259,400 Box 3, 4, or 5, enter $155,650 Box 6, enter $311,300

Each income tax filing season the IRS usually publishes the 1040 form and 1040 instructions booklet in the month of December. Last year the 1040 instructions booklet was delayed until January due to last minute income tax law changes. Use the 2016 Form 1040 and 2016 Form 1040 Instructions booklet file links above to view, save, and print these To report income from a nonbusiness activity, see the instructions for Form 1040, line 21, or Form 1040NR, line 21. Also use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain income shown on Form 1099-MISC, Miscellaneous Income.

If you, your spouse with whom you are filing a joint return, or a dependent was enrolled in coverage through the Marketplace for 2016 and advance payments of the premium tax credit were made for this coverage, you must file a 2016 return and attach Form 8962. You (or whoever enrolled you) should have received Form 1095-A from the Marketplace with information about your coverage and any advance … Form 1040NR enters the 21st century It took a long time for the IRS to permit e-filing of the form, but now that it does, it makes life easier for taxpayers who may not be in the US.

Form 1040NR EZLine by Line instructions. A word about Rounding Off to Whole Numbers – You can round off cents to whole dollars on your return. If you do round to whole dollars, you must round all amounts. To round, drop amounts under $0.50 and increase amount from … 2016 Instructions for Schedule CA (540NR) References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

From the Filing Status Menu, select Form 1040NR Program NOTE: Once a Form 1040 return has been started for a client, it cannot be switched to a Form 1040NR return (and vice versa). If you completed Form 1040 / Form 1040NR in error, you will need to delete the return from the program and start a new Form 1040 / Form 1040NR return. using NJ E-File or New Jersey Online Filing: • Fastest and most secure way to complete your return • Easy and accurate • Direct deposit available New Jersey Online Filing Use the free, enhanced, and upgraded New Jersey Online Filing Service to file your 2019 NJ-1040 return. It’s simple and easy to follow the instructions, complete

Filing readiness for 2018 returns: the resources available to you are the form instructions (in draft form as of today), the 7 th Classic edition of “1040NR? or 1040? U.S. Income Tax Returns for Visa Holders + International Organization and Foreign Embassy Employees”, recent blogposts on the website, www.1040nror1040.com., and articles on the IRS website. 2016 Instructions for Schedule CA (540NR) References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC).

2016 Form RI-1040NR Nonresident Individual Income Tax Return RI SCHEDULE II AND III - ALLOCATION AND MODIFICATION FOR NONRESIDENTS RI CHECKOFF CONTRIBUTIONS SCHEDULE 26 Drug program account RIGL В§44-30-2.4.. 27 Olympic Contribution RIGL В§44-30-2.1..... Yes $1.00 contribution ($2.00 if filing a joint return). Please remember, filing your return electronically and requesting direct deposit is still the fastest way to receive your refund. You can file for free on MyTax Illinois, our online account management program for taxpayers. See our website for additional information. Form IL-1040 Due Date The due date for filing your 2016 Form IL-1040 and

Beginning with your 2016 Form 1040NR, you can electronically file (e-file) your return.We encourage you to e-file.When you e-file, you can save time, increase your accuracy, and more.For additional information, see Options for e-filing your returns – safely, quickly, and easily, later, or … page 1 of Form 1040NR, which had to be completed by those checking the filing status box on line 3 or 4, has been removed. You no longer need to place spouse information on the form. Filing exception changes. The filing exception for those whose only trade or business is the performance of personal services is not available in 2018. Schedule OI